Finstable is a leading consulting firm specializing in asset conversion to Digital tokens. We provide investors access to leading projects in Thailand, by using Blockchain technology to open up new financial opportunities in the digital era.

Finstable was founded in 2021 by rich experiences and professional team members such as economists, businessmen, engineers, and designers. As the first and only leading Digital Token Consulting and Business Implementation Company in the Southern region of Thailand. Our ultimate goal is to make venture capital more accessible and investors around the world able to invest in traditional assets through more choices of accessible investment channels.

We work closely with partners and regulators to ensure compliance with laws and regulations in Thailand and internationally. To meet the requirements, we are in the process of applying for a license as a Digital Asset Broker, Digital Asset Dealer, Digital Asset Investment Advisory, Fund Manager, and an ICO portal operator with The Securities and Exchange Commission of Thailand (SEC).

Our Vision

A leading integrated blockchain-based platform and solution provider in Asia.

Our Mission

1. World-class customer-centric platform provider.

2. Provide a total solution.

3. Have a strong and seamless relationship with stakeholders in blockchain technology

4. Create a creative and innovative workforce in the blockchain industry.

5. Decentralized Autonomous Organization (DAO)

6. Governance Risk and Compliance (GRC)

Digital Asset Business Operations

Finstable Co., Ltd.

The company is currently applying for business license

In the digital finance world, cryptocurrency has received widespread attention and become a medium of exchange of value that will replace the use of cash or even electronic money (E-money) which is popular nowadays. With the potential of decentralized computing technology that is working in the background called “Blockchain” which is safe and can build trust among users and reduce the role of intermediaries like financial institutions that have administrative costs. There were many new investors due to the heavily increasing attention on Cryptocurrency trading in our country. Although cryptocurrencies are considered one of the risky assets, many investors invest in digital assets without studying all the necessary information to invest in Cryptocurrency. This is due to the massive price rally of Bitcoin in 2021, as well as Tesla's $1.5 billion purchase of Bitcoin.

Digital Asset

Dealer

A person who provides services or holds themself out to the public as available to provide services concerning the trading or exchange of digital assets for its account in the normal course of business outside the digital asset exchange, excluding the dealers who act in the manner as specified in the notification of the SEC.

Digital Asset

Fund Manager

A person who provides fund management or demonstrates to the public that they are ready to manage the funds for other people to find the benefit from digital assets by acting as normal trade.

Digital Asset

Advisory Service

A person who advises people, directly or indirectly, on the value of digital assets or their investment suitability concerning digital assets, purchase, sale, or exchange of any digital asset as a normal trade, which receives fees or other compensation.

Digital Asset

ICO Portal

Electronic system provider for the offering of newly issued digital tokens which serves to screen the characteristics of the digital tokens that will be offered for sale to the issuer's qualifications, and to evaluate the completeness and accuracy of the digital token offering statement and draft prospectus, or any other information disclosed through such service providers.

Digital Asset

Exchange

Any center or network established for the trading or exchanging of digital assets without an intermediary which will use the Blockchain system to match or find counterparties, and organize or facilitate those who wish to buy, sell or trade digital assets that both parties can make an agreement or matching which acts as a normal trade and does not go through an intermediary.

Digital Asset

Broker

A person who provides services or holds themself out to the public as available to provide services as a broker or an agent for any person concerning the trading or exchange of digital assets in the normal course of business, in consideration of a fee or other remuneration, excluding the brokers or agents who act in the manner as specified in the notification of the SEC.

Digital Asset

Dealer

A person who provides services or holds themself out to the public as available to provide services concerning the trading or exchange of digital assets for its account in the normal course of business outside the digital asset exchange, excluding the dealers who act in the manner as specified in the notification of the SEC.

Digital Asset

Fund Manager

A person who provides fund management or demonstrates to the public that they are ready to manage the funds for other people to find the benefit from digital assets by acting as normal trade.

Digital Asset

Advisory Service

A person who advises people, directly or indirectly, on the value of digital assets or their investment suitability concerning digital assets, purchase, sale, or exchange of any digital asset as a normal trade, which receives fees or other compensation.

Digital Asset

ICO Portal

Electronic system provider for the offering of newly issued digital tokens which serves to screen the characteristics of the digital tokens that will be offered for sale to the issuer's qualifications, and to evaluate the completeness and accuracy of the digital token offering statement and draft prospectus, or any other information disclosed through such service providers.

Digital Asset

Exchange

Any center or network established for the trading or exchanging of digital assets without an intermediary which will use the Blockchain system to match or find counterparties, and organize or facilitate those who wish to buy, sell or trade digital assets that both parties can make an agreement or matching which acts as a normal trade and does not go through an intermediary.

Digital Asset

Broker

A person who provides services or holds themself out to the public as available to provide services as a broker or an agent for any person concerning the trading or exchange of digital assets in the normal course of business, in consideration of a fee or other remuneration, excluding the brokers or agents who act in the manner as specified in the notification of the SEC.

Digital Asset

Dealer

A person who provides services or holds themself out to the public as available to provide services concerning the trading or exchange of digital assets for its account in the normal course of business outside the digital asset exchange, excluding the dealers who act in the manner as specified in the notification of the SEC.

Digital Asset

Fund Manager

A person who provides fund management or demonstrates to the public that they are ready to manage the funds for other people to find the benefit from digital assets by acting as normal trade.

Digital Asset

Advisory Service

A person who advises people, directly or indirectly, on the value of digital assets or their investment suitability concerning digital assets, purchase, sale, or exchange of any digital asset as a normal trade, which receives fees or other compensation.

Digital Asset

ICO Portal

Electronic system provider for the offering of newly issued digital tokens which serves to screen the characteristics of the digital tokens that will be offered for sale to the issuer's qualifications, and to evaluate the completeness and accuracy of the digital token offering statement and draft prospectus, or any other information disclosed through such service providers.

Digital Asset

Dealer

A person who provides services or holds themself out to the public as available to provide services concerning the trading or exchange of digital assets for its account in the normal course of business outside the digital asset exchange, excluding the dealers who act in the manner as specified in the notification of the SEC.

Digital Asset

Fund Manager

A person who provides fund management or demonstrates to the public that they are ready to manage the funds for other people to find the benefit from digital assets by acting as normal trade.

Digital Asset

Advisory Service

A person who advises people, directly or indirectly, on the value of digital assets or their investment suitability concerning digital assets, purchase, sale, or exchange of any digital asset as a normal trade, which receives fees or other compensation.

Digital Asset

ICO Portal

Electronic system provider for the offering of newly issued digital tokens which serves to screen the characteristics of the digital tokens that will be offered for sale to the issuer's qualifications, and to evaluate the completeness and accuracy of the digital token offering statement and draft prospectus, or any other information disclosed through such service providers.

Digital Asset

Exchange

Any center or network established for the trading or exchanging of digital assets without an intermediary which will use the Blockchain system to match or find counterparties, and organize or facilitate those who wish to buy, sell or trade digital assets that both parties can make an agreement or matching which acts as a normal trade and does not go through an intermediary.

Digital Asset

Broker

A person who provides services or holds themself out to the public as available to provide services as a broker or an agent for any person concerning the trading or exchange of digital assets in the normal course of business, in consideration of a fee or other remuneration, excluding the brokers or agents who act in the manner as specified in the notification of the SEC.

Digital Asset

Dealer

A person who provides services or holds themself out to the public as available to provide services concerning the trading or exchange of digital assets for its account in the normal course of business outside the digital asset exchange, excluding the dealers who act in the manner as specified in the notification of the SEC.

Digital Asset

Fund Manager

A person who provides fund management or demonstrates to the public that they are ready to manage the funds for other people to find the benefit from digital assets by acting as normal trade.

Digital Asset

Advisory Service

A person who advises people, directly or indirectly, on the value of digital assets or their investment suitability concerning digital assets, purchase, sale, or exchange of any digital asset as a normal trade, which receives fees or other compensation.

Digital Asset

ICO Portal

Electronic system provider for the offering of newly issued digital tokens which serves to screen the characteristics of the digital tokens that will be offered for sale to the issuer's qualifications, and to evaluate the completeness and accuracy of the digital token offering statement and draft prospectus, or any other information disclosed through such service providers.

Digital Asset

Exchange

Any center or network established for the trading or exchanging of digital assets without an intermediary which will use the Blockchain system to match or find counterparties, and organize or facilitate those who wish to buy, sell or trade digital assets that both parties can make an agreement or matching which acts as a normal trade and does not go through an intermediary.

Digital Asset

Broker

A person who provides services or holds themself out to the public as available to provide services as a broker or an agent for any person concerning the trading or exchange of digital assets in the normal course of business, in consideration of a fee or other remuneration, excluding the brokers or agents who act in the manner as specified in the notification of the SEC.

Digital Asset

Dealer

A person who provides services or holds themself out to the public as available to provide services concerning the trading or exchange of digital assets for its account in the normal course of business outside the digital asset exchange, excluding the dealers who act in the manner as specified in the notification of the SEC.

Digital Asset

Fund Manager

A person who provides fund management or demonstrates to the public that they are ready to manage the funds for other people to find the benefit from digital assets by acting as normal trade.

Digital Asset

Advisory Service

A person who advises people, directly or indirectly, on the value of digital assets or their investment suitability concerning digital assets, purchase, sale, or exchange of any digital asset as a normal trade, which receives fees or other compensation.

Digital Asset

ICO Portal

Electronic system provider for the offering of newly issued digital tokens which serves to screen the characteristics of the digital tokens that will be offered for sale to the issuer's qualifications, and to evaluate the completeness and accuracy of the digital token offering statement and draft prospectus, or any other information disclosed through such service providers.

Digital Asset

Dealer

A person who provides services or holds themself out to the public as available to provide services concerning the trading or exchange of digital assets for its account in the normal course of business outside the digital asset exchange, excluding the dealers who act in the manner as specified in the notification of the SEC.

Digital Asset

Fund Manager

A person who provides fund management or demonstrates to the public that they are ready to manage the funds for other people to find the benefit from digital assets by acting as normal trade.

Digital Asset

Advisory Service

A person who advises people, directly or indirectly, on the value of digital assets or their investment suitability concerning digital assets, purchase, sale, or exchange of any digital asset as a normal trade, which receives fees or other compensation.

Digital Asset

ICO Portal

Electronic system provider for the offering of newly issued digital tokens which serves to screen the characteristics of the digital tokens that will be offered for sale to the issuer's qualifications, and to evaluate the completeness and accuracy of the digital token offering statement and draft prospectus, or any other information disclosed through such service providers.

Digital Asset

Exchange

Any center or network established for the trading or exchanging of digital assets without an intermediary which will use the Blockchain system to match or find counterparties, and organize or facilitate those who wish to buy, sell or trade digital assets that both parties can make an agreement or matching which acts as a normal trade and does not go through an intermediary.

Digital Asset

Broker

A person who provides services or holds themself out to the public as available to provide services as a broker or an agent for any person concerning the trading or exchange of digital assets in the normal course of business, in consideration of a fee or other remuneration, excluding the brokers or agents who act in the manner as specified in the notification of the SEC.

Digital Asset

Dealer

A person who provides services or holds themself out to the public as available to provide services concerning the trading or exchange of digital assets for its account in the normal course of business outside the digital asset exchange, excluding the dealers who act in the manner as specified in the notification of the SEC.

Digital Asset

Fund Manager

A person who provides fund management or demonstrates to the public that they are ready to manage the funds for other people to find the benefit from digital assets by acting as normal trade.

Digital Asset

Advisory Service

A person who advises people, directly or indirectly, on the value of digital assets or their investment suitability concerning digital assets, purchase, sale, or exchange of any digital asset as a normal trade, which receives fees or other compensation.

Digital Asset

ICO Portal

Electronic system provider for the offering of newly issued digital tokens which serves to screen the characteristics of the digital tokens that will be offered for sale to the issuer's qualifications, and to evaluate the completeness and accuracy of the digital token offering statement and draft prospectus, or any other information disclosed through such service providers.

Digital Asset

Exchange

Any center or network established for the trading or exchanging of digital assets without an intermediary which will use the Blockchain system to match or find counterparties, and organize or facilitate those who wish to buy, sell or trade digital assets that both parties can make an agreement or matching which acts as a normal trade and does not go through an intermediary.

Digital Asset

Broker

A person who provides services or holds themself out to the public as available to provide services as a broker or an agent for any person concerning the trading or exchange of digital assets in the normal course of business, in consideration of a fee or other remuneration, excluding the brokers or agents who act in the manner as specified in the notification of the SEC.

Digital Asset

Dealer

A person who provides services or holds themself out to the public as available to provide services concerning the trading or exchange of digital assets for its account in the normal course of business outside the digital asset exchange, excluding the dealers who act in the manner as specified in the notification of the SEC.

Digital Asset

Fund Manager

A person who provides fund management or demonstrates to the public that they are ready to manage the funds for other people to find the benefit from digital assets by acting as normal trade.

Digital Asset

Advisory Service

A person who advises people, directly or indirectly, on the value of digital assets or their investment suitability concerning digital assets, purchase, sale, or exchange of any digital asset as a normal trade, which receives fees or other compensation.

Digital Asset

ICO Portal

Electronic system provider for the offering of newly issued digital tokens which serves to screen the characteristics of the digital tokens that will be offered for sale to the issuer's qualifications, and to evaluate the completeness and accuracy of the digital token offering statement and draft prospectus, or any other information disclosed through such service providers.

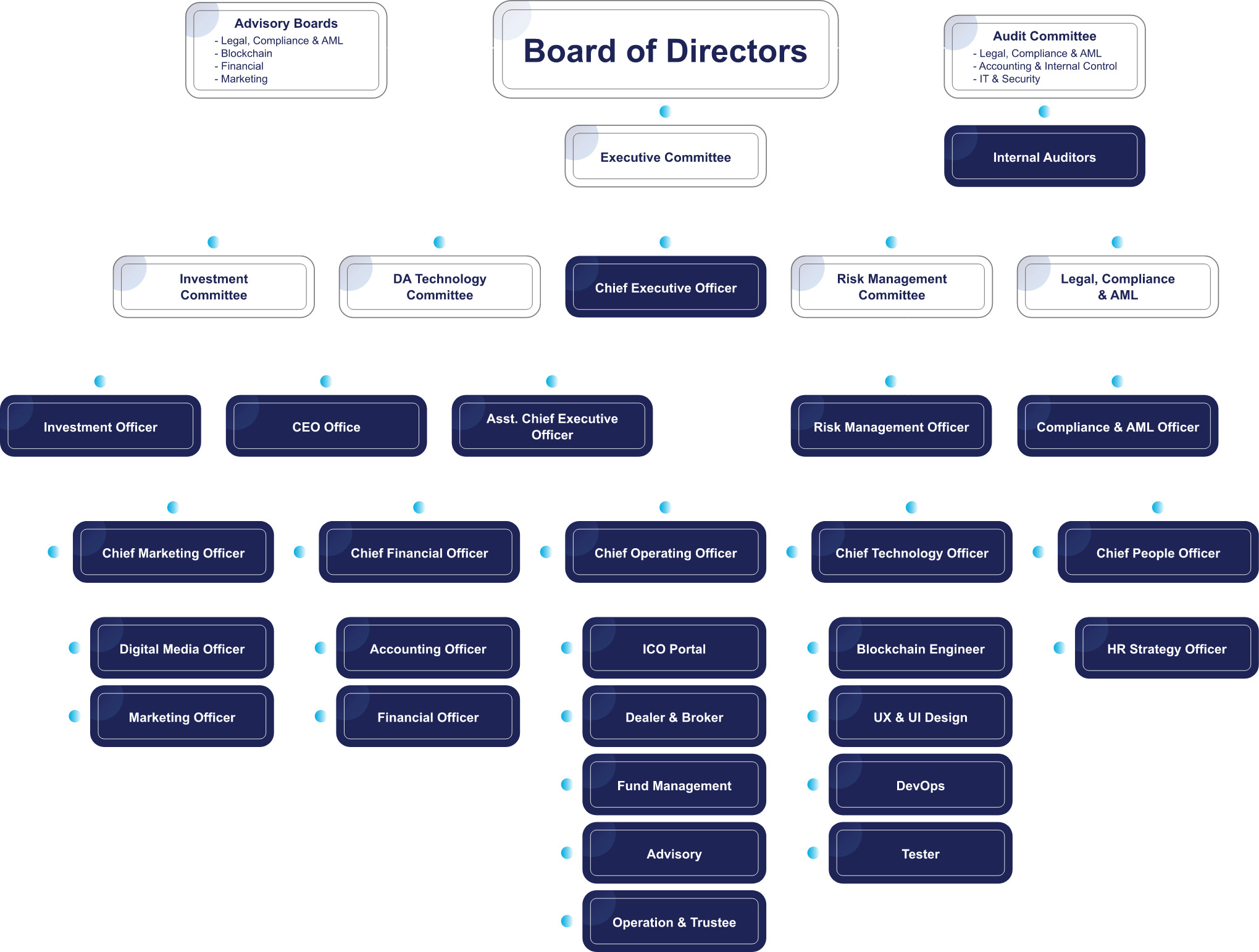

orgranization chart

Advisory Board

Prof.Tongthong

Chandransu

Legal Advisory Board Chairman

Expert Member of the Executive Committee of the Neighboring Countries Economic Development Cooperation Agency and a Qualified Advisor to the Preparatory Committee for Reconciliation under the Strategic Transformation Office (STO)

Samak

Chaowapanan

Legal, Compliance & AML Advisor

A former Executive Vice President and Spokesperson of Lawyers Council, a director of Thai Bar Association under the Royal Patronage, Managing Director of the Institute of Legal Education of the Thai Bar, a member of the National Economic and Social Advisory Council, and the former chairman of the Justice Council in the 1st and 2nd period, the Senate Judiciary Committee and Police

Anuporn

Aroonrut

Legal, Compliance & AML Advisor

An advisor to the President of the Lawyers Council under the Royal Patronage, and former President of the Lawyers Association of Thailand. Expertise in Energy, Intellectual Property, Natural Resources and Environment, Telecommunication, Information Technology

Asst. Prof. Dr.

Warodom Werapun

Blockchain Technology Advisory Board Chairman

He is currently an assistant professor, and an associate dean for research and innovation at the College of Computing,Prince of Songkla University, Phuket Campus, Thailand. He and his students won the first runner-up awards from "PSU COIN" and "The Arbitrage System" at NSC2020, NSC2021 and TICTA award 2020

Ayutt

Intaratpadit

GameFi & NFT Advisor

A specialist in Digital Economics and Information Technology Systems Blockchain technology information system implementation and also has special expertise in NFT systems, Metaverse, and currently serving as a teacher of the Department of Research and Innovation, College of Computer Science Prince of Songkhla University, Phuket Campus, Thailand

Asst. Prof. Dr.Tanate

Panrat

Blockchain Technology Advisor

Ph.D. (Molecular Biology and Bioinformatics) Interested in the research of Developing computational algorithms and analyzing software for data visualization, error correction and genomic sequence detection. These computational techniques can be used for solving many problems in molecular biology and can be applied to data mining and computational algorithms for animals and plants genome analysis.

Samret

Wajanasathian

Blockchain Technology Advisor

He is currently the Chief Technology Officer for ShuttleOne Network to develop blockchain projects. He is recognized for his expertise in C/C++ and Agile Methodologies+

Professional Team

Eitti

Ponguussara, PhD

Chairman, Board of Directors

Chairman of the Executive Committee

DA Technology Committee

Director of the Bank in IT Innovation and Risk Management and senior director of a finance company Specialized in Digital Banking, AI, and Derivatives With more than 20 years of experience and intent to develop and drive the Fintech.

Kiat

Wimonsopa

Board of Directors

Risk Management Committee

Former Senior Director of Siam Commercial Bank PCL with 34 years of experience in the personal, small, and large credit business, and experienced in financial analysis and risk assessment of various business projects.

Bhawat

Yupabhorn

Board of Directors

Executive Committee

Accounting & Internal Control Committee

Independent Director, a senior executive of Non-Governmental Organizations (NGOs) in various businesses Specializing in Accounting, Law, Economics, Risk Management Internal Control, and Information Technology and a Certified Public Accountant Former member of the Financial Reporting Standards Committee Federation of Accounting Professions Former Senior Auditor, SEC Office, TFAC Academy Working Group of the Federation of Accounting Professions.

Nipon

Aekwanich

Board of Directors

Investment Committee

A leading businessman in Phuket and has expertise in tourism economics management for more than 20 years and is also the founder of Phuket City Develop Company.

Sak

Segkhoonthod, PhD

Board of Directors

IT & Security Committee

Consultants and directors of various government agencies, Former Director of the Digital Government Development Agency with more than 25 years of experience in various IT fields from the development of the government’s Cloud System to Open Data and Data Governance. The current work is to drive the country's Digital ID system and to regulate new technologies such as AI, Blockchain, and Data Sharing.

Dr. Apichit

Santingamkul

Board of Directors

Legal, Compliance & AML Committee

He has extensive experience in the areas of commercial dispute, real estate, construction contracts, torts, criminal law, administrative law and arbitration. has more than 15 years as court trial lawyer specialized in commercial, labour, consumer- related dispute and medical negligence. Medical malpractice and health care trial service is his unrivalled expertise.

Samarn

Takort

Head of Legal

He has extensive experience in Financial and Business law in Thailand and International for almost 30 years. He holds attorney-at-law license, Advanced Certificate in Public Administration and Law for Executive, Certificate in Administrative Law and Administrative Law Procedure from Supreme Administrative Court.

Phadet

Jinda, PhD

Secretary, Board of Directors

Executive Committee

Chief Executive Officer

Information System Research & Development Researcher, his research was supported by The Thailand National Innovation Agency (PublicOrganization): NIA and awarded a Startup Thailand Pitching Grand Challenge 2016. He is Data Scientist, who spend more than 5 years in FinTech, Cryptocurrency and Blockchain Technology until now.

Onuma

Pumbute

Asst. Chief Executive Officer

She is a cryptocurrency and currency exchange business founder with more than 1,000 million Baht of fund size. She has over 3 years of experience in Cryptocurrency Investment Company. She has very rich experience in management of the Over-the-Counter Trade: OTC and the Digital Asset Dealers Systems.

Amorn

Suksawat

Chief Marketing Officer

He has very rich experience in Online Marketing and Corporate Identity Branding with 25 years experience. He is also experienced in Blockchain and Cryptocurrency Trading Systems. He is Founder of the Bitcoin Challenge Trading Community, and guess speaker in Bitcoin, Cryptocurrency and Blockchain Technology. He has obtained the 5th level of leadership (John C.Maxwell).

Atthapol

Wongtawepittayakul

Chief Financial Officer

He has experience over 25 years in auditing financial statements of public limited companies listed on the Stock Exchange of Thailand tax auditor which has been licensed by the Revenue Department for more than 7 years. He is currently a advisor accounting specialist for private companies and association.

Sarawut

Hanprombut

Chief Operating Officer

Expertise in Online Marketing, Digital Marketing, SEO, SEM, LINE OA, etc., and has experience in the crypto industry for more than 7 years and has been a co-developer of a crypto payment platform through the application and creating various media using NFT blockchain technology and experienced in customer and producer management.

Tanakorn

Karode

Chief Technology Officer

He is a computer engineer who has experience with website development and mobile development for 3 years. He has also developed decentralized applications on Ethereum, Binance Smart Chain, and Near Protocol using Solidity and Rust programming languages. He and his team presented a project named "PSU Coin" and got the first runner-up prize in TICTA2020.

Patcharakorn

Tila

Chief People Officer

Human Resource Management Manager with over 15 years of experience in human resource management and development planning for hospitality industry organizations and real estate business organizations, as well as specializing in Developmental Psychology to develop personnel in the organization effectively.